Gardencup Salad Experience: A Surprising Delight

The author shares their positive experience with Gardencup protein-packed salads, initially skeptica

Elevating Virginia's Wine and Culinary Scene: A Harmonious Pairing

The article discusses the joys of autumn and the perfect wine and food pairings for the season. It h

Verona Pharma Reports Third Quarter 2024 Financial Results and Provides Corporate Update

Verona Pharma reported strong Q3 2024 results for its COPD drug Ohtuvayre (ensifentrine), with net s

Uncovering the Vibrant Flavors of Guatemalan Cuisine at Tikal Mayan Food

Tikal Mayan Food is an ambitious Guatemalan restaurant in Lenox Hill, New York, owned by Noe Rodrigu

Country star Walker Hayes gifts huge tips to Nashville Waffle House workers

Country star Walker Hayes and Lexy Burke surprised three Waffle House employees in Tennessee with

Carnival of colour: fashion designer Isabela Capeto’s Rio apartment

Isabela Capeto, a fashion designer, has always dreamed of living in her flat overlooking Rio de Jane

New Zealand Tennis

It seems like the original text provided is incomplete or may have been formatted incorrectly, as it

10 Disturbing Confessions from Killers

The article provides a weather forecast for Charlottesville, Virginia (22901) for today and tonight.

Rediscovering Lost Melodies: The Timeless Allure of Classic Songs

This year, the author explored various musical discoveries that resonated deeply. Completing Duoling

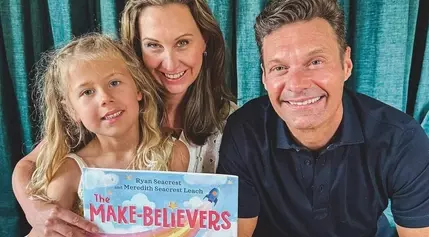

Ryan Seacrest and Sister Meredith Say ‘Pretending’ to Be ‘Bon Jovi and Madonna’ as Kids Helped Inspire New Book (Exclusive)

Ryan Seacrest and his sister Meredith have co-authored a children's book, "The Make-Believers," insp

‘We are in desperate need of food’: Bellevue Community Food Bank says donations have plummeted

The Bellevue Community Food Bank in Nashville, Tennessee, is facing a surge in demand for its servic

Guernsey’s shrinking economy down to finance sector decline

Guernsey's economy shrank by 2% in 2023, primarily due to a 3% decline in the finance sector, which

Judge Declines to Penalize President-Elect for Felony Conviction

In a notable legal decision, a judge opted against imposing fines, jail time, or probation on U.S. P

Kamala Harris is an honorary member of Gen X. Here’s how her finances compare to others of that generation

Kamala Harris, the current U.S. Vice President, represents a generational shift in politics. Born on

1 in 3 drivers owe more on their car loan than the vehicle is worth, report finds

According to a new survey, about 1 in 3 American drivers who financed their vehicle are now "underwa

Wrong-way crash between car, 18-wheeler shuts down parts of I-30, Arlington police say

A wrong-way driver crashed into an 18-wheeler on Interstate 30 near Six Flags Drive in Arlington, Te

The Van with a Temporary Tag: A Nationwide Scam Unveiled

A WSMV investigation found the same van with a temporary tag used in different cities for a scam whe

Game studio co-founded by Dr Disrespect “immediately” terminating relationship with the streamer

Midnight Society, the game studio co-founded by Dr Disrespect, has terminated its relationship with

Dead by Daylight spin-off Project T has been cancelled

Behaviour Interactive has announced the cancellation of its Dead by Daylight spin-off project, Proje

When Does the Final Fantasy XIV Dawntrail Maintenance Start and End?

The Final Fantasy XIV Dawntrail expansion will be released on July 2nd, 2024, with Early Access avai